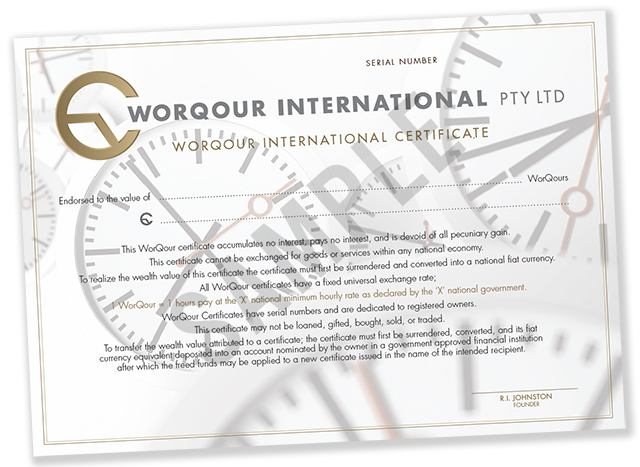

Worqour Certificates

The WEAPD/WorQour currency and payment system functions as a bridge between national economies/currencies and in this regard it is external to every economy.

Once a fiat currency has been exchanged into ‘units of time’ (Worqours) it has, in essence, been moved outside the domestic/national economy. Once outside that domestic economy the fiat currency value can be stored indefinitely ‘in limbo’ as Worqour units of time with a monetary value.

National Worqour certificates were created specifically for storing large fiat currency values, outside the domestic economy, in a tangible form.

Worqour Certificates supply a method of wealth storage that rivals the benefits offered by tax havens, gold or cryptocurrencies.

The system offers two types of certificates; Domestic/National, and International.

National (Domestic) Certificates

National certificates have a national origin and can only be surrendered in exchange for their original currency. When their value needs to be re-introduced back into an economy the certificates can be instantly redeemed but only for/in their inceptive fiat currency.

Worqour certificates have distinct advantages over investing in Gold bullion. The certificates have serial numbers and registered owners. Being a certificate they are easy to transport and store.

Each certificate is issued for a single purpose and the transfer of the certificates value between two parties requires the certificate to be surrendered into the owner’s bank account and a new certificate issued in the recipient’s name.

This ensures the certificates cannot be bought, sold, or traded in the current commercial sense as fiat currency derivatives presently are.

Damaged or lost certificates can be easily replaced and stolen certificates are worthless.

As Worqour units of time their mHR of exchange gives them an inflation-adjusting feature. Over time, any changes in the mHR are automatically applied when the certificate’s value is converted and deposited into the owners bank account.

The exchange formula uses the stable mHR and this also gives the certificates a predictable surrender value.

National Worqour Certificates are NOT used in domestic business transactions as a payment in exchange for goods or services.

They cannot be transferred internationally nor can they be used to settle cross-border transactions.

Foreign funds entering the economy with the intention of gaining local certificates must first be deposited into a local bank.

The certificates accumulate no interest and are tax-free. They have a perpetual value and their mHR of exchange gives them an exact and predictable surrender value.

International Worqour Certificates

INTERNATIONAL Worqour certificates were specially devised to overcome the ‘one currency’ restrictions placed on the NATIONAL Worqour Certificates whos primary function is storing wealth.

INTERNATIONAL Worqour certificates can be converted into any national currency.

However, their use is reserved for the exclusive use of the Worqour’s administrating body and are issued solely at that body’s discretion whenever they see a need.

These certificates are not available to the public.

These certificates are used internally, for transferring funds between branches, as a store of Worqour profit wealth, and as a payment method for large international commodity contracts etc. In one way this last arrangement will resemble the role currently performed by the Bank of International Settlements.

Gold

The more instantly available and unlimited supply of Worqour certificates, with their stable guaranteed surrender value, do not ‘peak’ in cost/value during financial disasters. Worqour certificates will always be readily available and the rush for gold during global wealth threatening situations will become a thing of the past.

Worqour Pricing of Gold

In gold producing nations the cost of locating, extracting and refining gold can be calculated in the national currency. This cost can then, using the national mHR, be converted into international ‘units of time’ (Worqours).

As a result gold may be offered at various ‘units of time’ (Worqour) prices from different locations around the world. When the suppliers of cheaper gold run out the next most cost efficient producers will take their place.

Gold will always hold a fascination and as the metal becomes harder to locate and extract its price in ‘units of time’ (Worqours) will increase accordingly.

Crypto Currencies

Investing in either gold or Crypto currencies exposes those owners to unpredictable and sometimes volatile buy-back rates. The stable mHR used in the Worqour exchange rates ensures people owning Worqour certificates are NOT exposed to a similar volatility. Worqour certificates have a stable and predictable surrender value.

Also, there’s a conflict between the wealth storing feature and the payment feature in Crypto currencies. The wealth storing feature has a volatile speculative element. The Crypto system’s transaction costs are excessive both financially and in the amount of energy it takes to process those transactions.

These problems do not exist in the Worqour system. The Worqour Certificate exchange rates are not open to speculation. The mHRs are not volatile and the transaction processing costs are in line with established currency transfers.