A Second Configuration

The primary configuration as outlined in the patent can be reconfigured.

This second configuration of the WEAPD/Worqour currency and payment system creates money.

The Worqour/WEAPD’s first and original ‘basic transaction’ set-up, as described in the patent, was intended for cross-border currency transfers and payments.

This process involves three devices and three locations. Two of the devices are satellite devices located in two different nations and the WEAPD, positioned at a third location, somewhere in the middle (figuratively speaking), processes and transfers existing funds, between financial institutions in those two nations.

The second WEAPD configuration creates money and this will be of particular interest to Banks, Large Businesses and Governments.

The simplest way to explain the second configuration is to envisage three devices but only two locations.

This second configuration requires a targeted satellite device located somewhere in the world at the first location, and at the second location, the WEAPD and the third device are both housed in the same building.

The difference here is that the third device is not connected directly to, nor does it access, existing national fiat currency funds.

The third device functions as a Data Entry Portal (DEP).

The WEAPD treats the DEP as an authorized device possibly located elsewhere in the world.

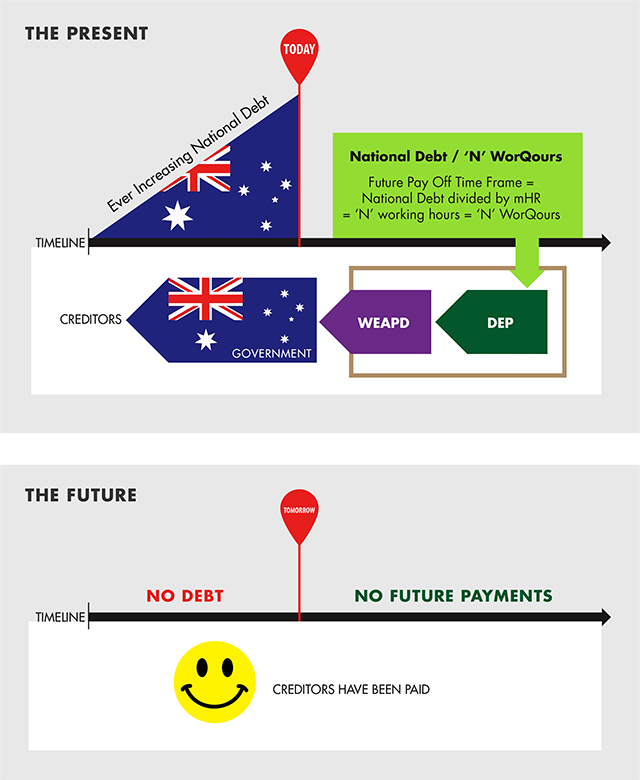

‘Units of time’ (Worqours) equivalent to any national fiat currency amount can be manually entered into the DEP and transferred through the system into a government approved financial institution within the national economy. Apart from meeting the funding needs of banks this procedure can even be used to clear the entire national debt of a country.

Pay-off Diagram – shows how the second configuration of the system can be used to introduce funds into an economy.

At present many national banks meet the bulk of their lending needs with money sourced externally. This practice exposes the banks and their customers to interest rate fluctuations dictated by external forces or events.

The second WEAPD configuration has the potential to supply, directly into a bank, limitless funds at very competitive interest rates.

WEAPD/ Worqour loans are supplied from a neutral source and therefore not subject to fluctuations emanating from foreign / external monetary policy.

Also, loans, sourced using the second configuration of the WEAPD, are not subject to the dictates of a global reserve currency central bank.

Nor are they subject to the whims of investors who may withdraw their funds for the purpose of reinvesting somewhere else for better returns.

WEAPD/ Worqour loans retain their initial ‘semi-fixed’ financial agreements for the duration of the contract. Semi-fixed in the sense that the loans may be subject to a once yearly national review of the mHR. Even with this review the financial landscape remains stable, clear, and predictable, allowing borrowers, like banks, to retain full control of their borrowing interest payments and lending rates.