Mount Washington Hotel located at Bretton Woods

BRETTON WOODS

In July 1944, before the Second World War came to an end, 730 delegates from 44 Allied Nations gathered in the Mount Washington Hotel located at Bretton Woods, New Hampshire, USA.

They gathered in an attempt to formulate a monetary solution that would prevent the events that precipitated two world wars.

Key issues on the agenda were;

1. How to conduct trade without fear of sudden currency depreciation or wild fluctuations in currency exchange rates,

2. To develop a system that allowed all nations equal access to raw materials.

3. What to do about the effect of subsidised labor and sweated competition in the export markets when good currency exchange rates sent jobs overseas.

The WEAPD / WorQour business method addresses all of these issues.

1. How to conducted trade without fear of sudden currency depreciation or wild fluctuations in currency exchange rates, frequently caused by some trading nations using currency devaluations as an attempt to increase their competitiveness (i.e. raise exports and lower imports) that could possibly degenerate into a form of trade/currency war.

Preventing a repetition of this process of competitive devaluations became job number one.

The WorQour conversion utilizes the stable national mHRs for its fiat currency exchange rates. National mHRs stay unchanged for months possibly years. They are not vulnerable to manipulation nor are they affected by sudden international events.

These stable mHR WorQour exchange rate fosters a system of international payments that will allow trade to be conducted without fear of sudden currency depreciation or wild fluctuations in exchange rates.

2. A system that allowed all nations equal access to raw materials,

The WorQour conversion rates do not increase the spending power of a strong currency they increase the purchasing power of the poorer currencies.

National fiat currencies are converted instantly to and from the WorQour bridging currency as required. There is no need for any nation to hold overseas funds.

This allows all nations equal access to trade and raw materials because no nation is restricted by poor currency exchange rates or a shortage / absence of overseas funds.

3. What to do about the effect of subsidised labor and sweated competition in the export markets when good currency exchange rates sent jobs overseas.

Sweated labour relates to or denotes manual workers employed at very low wages for long hours and under poor conditions. This is made possible by favourable fiat currency exchange rates. A strong currency can be exchanged for large amounts of a weaker currency.

Companies using the favourable exchange rates are simply reducing overheads and increasing profits. Unfortunately these favourable exchange rates have seen developed economies with strong currencies loose work and local industry as jobs and production are relocated overseas.

Also, the protection established for workers in developed economies is absent. Sweathouse workers are often forced to work in environments that would not be tolerated in the developed world.

The subsidisation of labor and sweated competition in the export markets still exists and nothing has changed in close to 100 years. By taking advantage of good fiat currencies exchange rates that allow them to harness cheap labour firms are still sending jobs overseas.

When one WorQour equals the rate of pay for the lowest paid worker in every fiat currency the national mHR(s) rates of exchange makes the transfer of jobs overseas financially non-viable.

The WorQour conversion rates do not increase the spending power of a strong currency. They increase the purchasing power of the poorer currencies.

In an economy with favourable fiat currency exchange rates employing one worker at the mHR can equal employing several workers elsewhere at their national mHR. These favourable currency exchange can increase the employment ratios from 1:3, 1:4, 1:5 etc. Depending on the strengths of the two currencies.

The WorQour’s mHR exchange rate does not support this practice. One worker paid at the mHR in one nation is equal to one worker paid at the mHR in another nation.

1 person paid at the national mHR = 1 x WorQour = 1 person paid at the national mHR.

The WorQour bridging currency exchange rate supplies a basic 1:1 employment ratio.

Jobs that have gone overseas will likely return because the WorQour doesn’t supply the same favourable exchange rates necessary to keep the work there.

The introduction of the WorQour will see the local industries lost to cheaper workforces, re-established as labour costs reclaim their competitiveness.

The freight and postal charges for bringing produce from overseas will also play an important role. This may even tip the equation in favour of nationally produced goods. High quality local products having competitive labour costs will re-emerge back into the market.

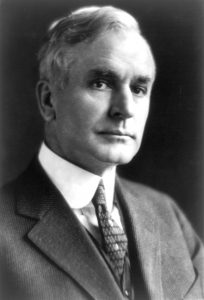

Cornell Hull US Secretary of State

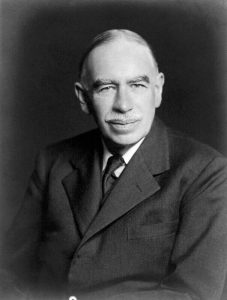

British economist John Maynard Keynes

The WorQour bridging currency fulfills the hopes and dreams of those attending the conference at Bretton Woods in 1944.

Cornell Hull US Secretary of State 1933-44 said "Unhampered trade dovetailed with peace…high tariffs, trade barriers, and unfair economic competition, with war…if we could get a freer flow of trade…freer in the sense of fewer discriminations and obstructions…so that one country would not be deadly jealous of another and the living standards of all countries might rise, thereby eliminating the economic dissatisfaction that breeds war, we might have a reasonable chance of lasting peace".*

In 1944 the British economist John Maynard Keynes emphasized, "the importance of rule-based regimes to stabilize business expectations"

July 22, 1944, Keynes stated, "We, the delegates of this Conference, Mr. President, have been trying to accomplish something very difficult to accomplish.[...] It has been our task to find a common measure, a common standard, a common rule acceptable to each and not irksome to any".**

The WorQour bridging currency fulfills the hopes and dreams of those attending the conference at Bretton Woods in 1944.

*Hull, Cordell (1948). The Memoirs of Cordell Hull: vol. 1. New York: Macmillan. pp. 81.

**Comments made by John Maynard Keynes in his speech at the closing plenary session of the Bretton Woods Conference on July 22, 1944 in Donald Moggeridge (ed.), The Collected Writings of John Maynard Keynes (London: Cambridge University Press, 1980), vol. 26, p. 101.